Executive pay, diversity and financially material ESG factors were points of focus for proxy voting in the past 12 months, according to the latest Engage report by the International Equity team at Morgan Stanley Investment Management.

Bruno Paulson, managing director for the International Equity team at Morgan Stanley Investment Management says proxy voting can play a key role in enhancing long-term investment returns – and highlights the increased attention paid to it by company boards and management. Due to this, the team does not outsource proxy voting and it is not afraid to disagree with management and third-party proxy advisers.

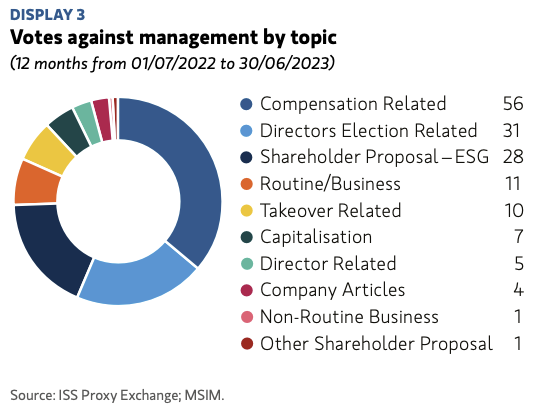

Bruno Paulson says common reasons for voting against management were related to compensation, election of directors and shareholder ESG proposals, noting that “Executive pay remained a key focus. We voted against 22 per cent of management say on pay resolutions”[1].

The pay industry has certainly succeeded in increasing the rewards for chief executive officers, who the Economic Policy Institute claims are now paid 344 times as much as a typical worker, in contrast to 1965 when they only earned 21 times as much[2].

Mr Paulson said it is important for long-term investors to encourage companies to have pay plans in place for long-term thinking, over short-term opportunism. He highlights that the wrong incentives, for instance excessive focus on earnings per share (EPS), can encourage management to take decisions that boost profits in the short run at the expense of their companies’ ability to compound over the long run.

The team’s proprietary Pay X-Ray scoring framework is used to evaluate pay schemes where relevant and possible, engaging with boards to improve them and voting against them where the team is unhappy with the structures. Where the team has had long-standing unresolved concerns over pay, they voted against members of remuneration committees to make their message heard.

They have also voted against nomination committee members if they have had concerns over diversity. In total they voted against the election of 27 (4 per cent) directors in the last 12 months.

Mr Paulson explains “How companies approach diversity, equity and inclusion (DEI) may present potentially financially material issues, and there are many studies that support this view”.

One of these, a study by Boston Consulting Group, found that companies with leadership teams that have above-average diversity generate, through product innovation, revenues that are 19 percentage points superior to companies with less diverse leadership teams, and enjoy higher earnings, before taxes and interest (EBIT) margins[3]. Higher levels of gender diversity also has shown fewer instances of governance-related controversies, including bribery, corruption and fraud, according to a study by MSCI[4].

The International Equity team believe direct engagement with companies is the best route to assess a company’s approach to DEI, which includes understanding a company’s strategy, policies and reporting. Meeting management affords them the opportunity to gauge integrity, ask the difficult questions, nudge for progress and, where they believe it to be financially material, encourage improvement.

As it relates to proxy voting, the team’s voting seeks to be consistent with their assessment of the materiality of specific issues (ESG or other) to the sustainability of companies’ returns on capital, their monitoring of company progress, and their efforts to encourage companies towards better and/or more transparent practices. When they receive any environmental or social related shareholder proposals, they carefully consider how to vote on them by determining the relevance of the issues and the likely financial impact and its materiality.

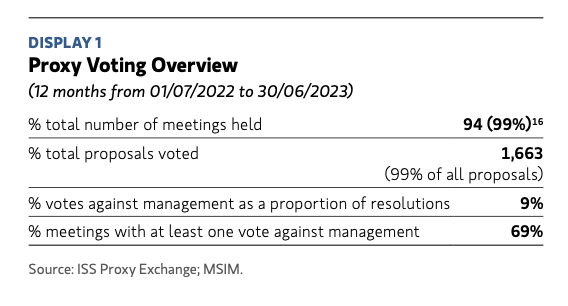

During the 12-month period, the International Equity team at Morgan Stanley Investment Management voted at 94 meetings, 99 per cent of all meetings held by companies held by the firm, and on 1,663 proposals (99 per cent of all proposals submitted).

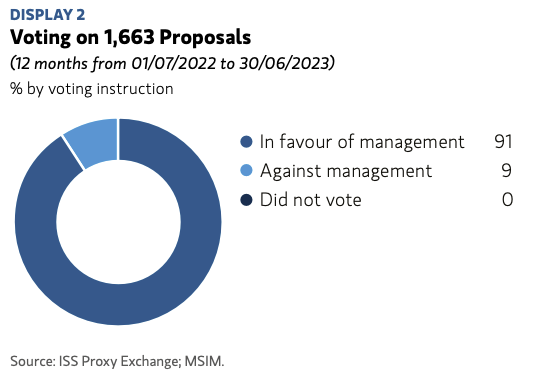

Overall, the International Equity team at Morgan Stanley Investment Management voted against management in 9 per cent of cases, and 69 per cent of meetings had at least one vote against management.

The common reasons for voting against management were related to compensation, election of directors and shareholder ESG proposals, which have not changed since the previous period.

[1] 12 months from 01/07/2022 to 30/06/2023.

[2] Economic Policy Institute report on CEO pay in 2022. Published 21 September 2023.

[3] Rocío Lorenzo, Nicole Voigt, Miki Tsusaka, Matt Krentz, and Katie Abouzahr, “How Diverse Leadership Teams Boost Innovation”, Boston Consulting Group, 2018.

[4] Linda-Eling, Lee Ric Marshall, Damion Rallis, Matt Moscardi. “Women on Boards: Global Trends in Gender Diversity on Corporate Boards,” November 2015.

About SG Hiscock & Company

SG Hiscock & Company (SGH) is an Australian fund manager specialising in high conviction actively managed investment strategies and individual portfolios. SGH was established in Melbourne in 2001 by six of its principals and is entirely owned by staff. The head office is in Melbourne with another office in Sydney. In early 2019, SGH merged with specialist discretionary portfolio manager, DMP Asset Management, now part of SGH Individual Portfolios. The firm commenced the SGH Partnership Program in June 2020, this program comprises LaSalle Investment Management Securities, Morgan Stanley Investment Management and EAM Global Investors. SG Hiscock also has an exclusive distribution partnership with abrdn. SGH now offers over 20 different strategies across Australian and Global equities, REITs and income. More information: www.sghiscock.com.au

About Morgan Stanley Investment Management

Morgan Stanley Investment Management, together with its investment advisory affiliates, has more than $1.5 trillion in assets under management or supervision as of December 31, 2023. Morgan Stanley Investment Management strives to provide outstanding long-term investment performance, service and a comprehensive suite of investment management solutions to a diverse client base, which includes governments, institutions, corporations and individuals worldwide. The combination with Eaton Vance allows the firm to bring even more value to clients through many high quality, complementary investment offerings, delivered with an unwavering commitment to client service. Professionals across the globe draw upon these capabilities to develop strategies that address a wide range of investors’ needs across the public and private markets.

For further information about Morgan Stanley Investment Management, please visit www.morganstanley.com/im.

Plants, seeds & more delivered to your door!

www.nativeshop.com.au

Advertisement